Track Your Equity & Home Wealth

- Clare R. Okyere

- Nov 3, 2023

- 2 min read

Knowing a home's estimated value and tracking your home's wealth can help you make informed decisions about selling, buying, refinancing or remodeling choices.

Why Would I Want a Home Value Estimate?

A good way to be financially savvy is to track your home's value. There are many reasons to do so. Knowing the value of your home prepares you to buy, sell, refinance, convert to a rental, remodel, etc. If you are considering a move, a home value estimate gives you a starting point to determine what you can afford to buy as well as how to price your house to sell.

How is a Home's Value Estimated?

You can get the estimated value of your home without paying for a full appraisal. This is done by comparing the target home to other comparable properties (often referred to as "comps") in the area. Reliable comps take things like location, square footage, and property type into account when comparing value. Homebot is a free interactive tool you can use to track your equity and home wealth.

This sample Homebot report shows a home's estimated value and how it has changed over time. Based on the amount owed on the home, it also estimates the net worth of the home in the event it were to be sold.

What if I Have No Plan to Sell?

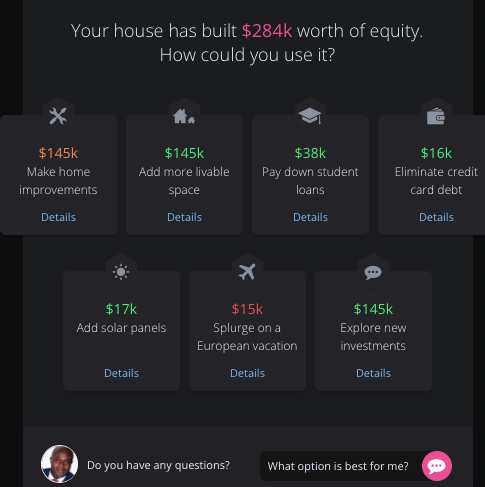

Even if you have no intention to sell, it is still empowering to track your home value. Your home is not merely an expense; it is an investment and a vehicle to build wealth. On your free interactive Homebot report, you will also be able to monitor your mortgage, tips to save money over the life of your loan, home equity, rental potential, etc. The thumbnails below show a sample of topics you typically find in your Homebot report. Knowledge is power, and staying on top of your home's value gives you the knowledge to make informed decisions that lead you closer to your goals.

How Accurate is the Estimation?

A home value estimation tool attempts to be as accurate as possible given the current market and comparable properties. In Homebot, you will have the option to tune your information to make the free, interactive report as accurate as possible. It will never be 100% accurate, however. To get the most accurate home value estimate, you would need to pay for a full appraisal. This will be part of the process when you are ready to buy or sell a home; however, Homebot is a great tool to monitor your home value and make informed decisions in the meantime.

Ready to start building wealth through home ownership? Call our team at O Capital Group, or click below to get started online.

At O Capital Group, we make home loans easy!

Call today: (602) 492-8930

We love learning from your journey! Leave us a comment below.

#homevalue #homevalueestimate #CMA #comparativemarketanalysis #househunting #homeloan #homefinancing #FICO #financialliteracy #homeloansmadeeasy #brokersarebetter #homebuyer #firsthome #mortgagerates #mortgage #refinancing #phoenixneighborhoods #scottsdaleneighborhoods #avondaleneighborhoods #houstonneighborhoods #katyneighborhoods #dallasneighborhoods

This article is accurate and true to the best of the author’s knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional advice in business, financial, legal, or technical matters.

Comments